- Two of Nigeria's leading fintech companies have announced changes to how customers' accounts are verified

- The move is in response to both the CBN directive and a recent video of loopholes exploited by fraudsters

- The latest changes the fintech companies hope will ease the fears among customers

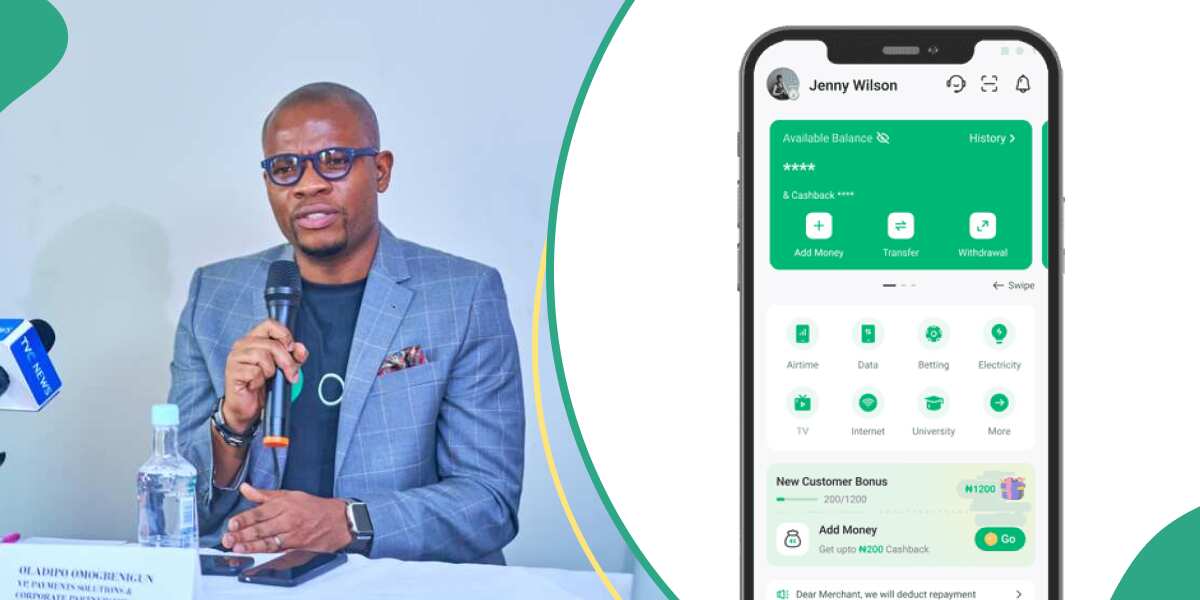

OPay and Palmpay have announced key changes to how customers get verified on their platforms.

The two digital banking platforms made the changes in response to reports of loopholes exploited by fraudsters when opening accounts.

Opay makes changes

For Opay, there are changes in the identification method of securing bank accounts during the onboarding process.

PAY ATTENTION: Сheck out news that is picked exactly for YOU ➡️ find the “Recommended for you” block on the home page and enjoy!

Read also

MTN, Airtel, Glo to block phone numbers without Nin in 2024, give deadlines for different categories

According to a statement made available to Legit.ng, customers will now have to provide a bank account verification to help users authenticate BVN

The company said the process was included because a BVN backs every account.

Opay statement reads:

“We introduced the bank account verification to help users authenticate BVN more conveniently (for example, where a user forgets their BVN). "For biometric validation, our system will verify the face of the user with that on the BVN database, or double-check with the user’s real-name. "This is combined with an OTP process which then certifies authenticity of the user. "This is more so, consistent with the CBN’s latest guidelines mandating BVN/NIN verification for Tier 1 users."Palmpay also announces new changes

Similarly, PalmPay has launched a new security in-app version that mandates all new users to input their BVN or NIN numbers before a wallet can be created.

Read also

“Not Fraud Related”: After Opay, PalmPay, Moniepoint speaks on reasons for transaction hitches

In a statement made available to Legit.ng, the company said the product launch is in response to the Central Bank of Nigeria's recent directive on promoting financial system stability by strengthening the Know Your Customer(KYC) procedure for customers.

Legit.ng also understands the adjustment is also in response to concerns about weak customer security checks during onboarding.

Palmpay explains upgrade

Speaking on the upgrade, Chika Nwosu, Managing Director of PalmPay, said the changes are for existing and new users having BVN or NIN.

His words:

“We are committed to ensuring compliance and fostering a secure financial ecosystem.“As a forward-thinking fintech platform, we believe that this measure will enhance the overall security of users' wallets and the protection of users' data while providing seamless financial services. “Through various in-app activities, we have always encouraged our users to link their wallets with their BVN or NIN. We are fully aligned to drive the new Directive.”

Read also

Electricity distribution company begs customers to pay N28bn debt amid rising inflation

Operating under the Mobile Money Operator license, PalmPay's wallet opening process requires new users to provide their NIN or BVN number.

Nwosu added.

"Also, to limit incidents of impersonation, after the successful input of the NIN or BVN, users will be required to proceed to the face recognition process. “In all of this, we believe this measure will reduce fraudulent activities and provide a safe banking environment for all.We encourage users to update their KYC information on the app to ensure compliance with the Directive."Nigerian fintech startup shuts down after raising $2m from over 18 investors

Earlier, Legit.ng reported that Pivo, a finance business based in Nigeria, intends to cease operations.

The firm closure comes just a few months after securing a $2 million seed round led by Y Combinator, Ventures Platform, Mercy Corp Ventures, and more than fifteen other investors.

Read also

Nigerian fintech introduces ePOS to rival Opay, PalmPay, others

Source: Legit.ng

ncG1vNJzZmivp6x7rbHGoqtnppdkr7a%2FyKecrKtdmrCwus6msGiln6OyunuQbm1yaGhrerGty6anmrFdpL2ixYyapaenpaOwpr%2BMrqedmaSawG6v1KyrqKWVp3q0scKuqaKsqWKwo7qMnKanm5Wnu7R5xauYrpyjqbKzedaaqaehnpzAcA%3D%3D